Mergers and acquisition transactions with a heavy technology component generally require more nuanced due diligence than the typical M&A transaction because of the extensive intellectual property (IP) involved. Even within M&A in the tech industry, necessary due diligence fluctuates depending on the deal structure. Whether the transaction is a merger, a share acquisition, an asset purchase, or a carveout will inevitably impact due diligence.

M&A lawyers performing the technology portion of due diligence in M&A transactions must be vigilant in reviewing any special agreements and ensuring compliance with IP-specific laws and regulations. Below, we have provided some IP due diligence guidance for acquisition lawyers and other stakeholders involved in buy-side IP due diligence.

Intellectual Property (IP) Items Buyers Should Review in Due Diligence

Licensing Agreements

If the seller has IP subject to a licensing agreement, the buyer should review the agreement for language governing the assignability. If the license agreement contains language declaring whether the license is assignable, then the express language will govern the licensed IP transfer.

If the license agreement does not contain express language concerning when the license may be transferred, U.S. courts typically hold that the licensor has the right to assign without consent, but the licensee does not have the right to assign unless the licensor consents. These outcomes change if allowing the transfer of the IP license would have a material adverse effect on the licensee or if the license is non-exclusive. Ultimately, if the agreement is silent, the ability to transfer the license rests on the type of licensed IP, exclusivity, and governing law.

Software Due Diligence

Software due diligence should always be conducted to ensure there are no security or ownership issues related to the software’s source code. Ownership and licensing violations in a company’s software code often go unnoticed, however, such violations can cause serious issues in an M&A transaction.

For software due diligence, acquisition lawyers should:

- identify the creator of the source code;

- ensure the proper security measures have been taken to protect the source code’s confidentiality;

- determine whether a source code scan is necessary;

- analyze the code development agreements; and

- research third party relationships and engagements

Artificial Intelligence (AI)

How do you value AI in due diligence? In a rapidly growing and changing market, this might be a difficult task for due diligence teams.

Although there are a few different approaches among acquisition attorneys to measuring the value and quality of AI assets, in any M&A transaction, the buyer should always evaluate the algorithm’s model, training set, input query, and output result. Due diligence teams should hire a data scientist, a product manager, or both to assist the team with analysis and comparisons to other AI products on the market.

AI Created by Humans vs. Another AI

Due diligence teams should also be aware of any IP protections AI assets have. Generally, whether an AI asset receives protection depends on who created the IP. If the AI was created by another AI system, U.S. courts generally will not extend patent or copyright protection. However, they will extend protection when created by a human.

While it remains a gray area of the law, many M&A law firms speculate that AI systems whose decisions result in damage may be held liable, regardless of the creator. If this is the case, new questions about copyright and patent protection may arise.

Employee & Contractor IP Due Diligence

Employees and contractors may present ownership issues in a tech M&A transaction. The due diligence teams must review the employment or independent contractor agreement to determine the following:

- Who owns the IP;

- Whether the IP is material to the seller; and

- If the governing state law restricts the assignment of employee inventions and requires notice in the employee agreement.

“Work Made for Hire” & “Commissioned for Use” Provisions

For employee agreements, the buyer should confirm that the agreements include a “work made for hire provision,” to ensure that the company retains rights to whatever IP is created in the course of employment. Conversely, contractor agreements should include a “commissioned for use provision” which, similar to the work made for hire provision, will ensure that any IP created by a contractor becomes the company’s IP.

Both agreements must also address moral rights of attribution, either through a waiver or assignment. For work product that is not considered work made for hire, the buyer should confirm the existence of both present and future assignment provisions.

Compliance with the Defend Trade Secrets Act

If the employee has knowledge of confidential trade secrets and the agreement was executed on or after May 12, 2016, under the Defend Trade Secrets Act, the agreement must include a whistle-blower notice.

Regardless of whether trade secrets have been disclosed, the agreements should contain confidentiality and cooperation provisions. The confidentiality provisions are used to protect against potential use or disclosure by the employee of the seller’s confidential information. Cooperation provisions require the employee or contractor to take the necessary actions to perfect IP ownership and work product.

Check for Third-Party Restrictions

The buyer should also examine the representations and warranties in the agreement to ensure that all work product and IP is original and does not violate any third-party IP rights. For example, a work product may contain background IP that is owned by the employee or contractor. This could cause issues for the M&A transaction. In this scenario, the buyer should confirm the existence of a license from the employer or contractor to the seller and whether the license contains any third-party restrictions.

Lien Due Diligence

Article 9 of the UCC provides that liens and security interests can be granted against IP assets unless they’re preempted by federal law. So, which federal laws preempt Article 9 liens against IP assets? In the realm of IP, only Copyright Act preempts Article 9 liens. The Patent Act and the Lanham Act for trademarks do not.

As a result, security interests in patents and trademarks, as well as their applications, are perfected by filing a UCC-1 financial statement in the state where the owner of the IP asset is located. The buyer may, and in most cases should file the security agreement with the U.S. Patent and Trademark Office to provide notice to future purchasers or mortgagees.

Security interests in copyrights, on the other hand, can be perfected only by filing security agreements with the U.S. Copyright Office.

If there is a release or termination of a security agreement, whether a patent, trademark, or copyright, the release or termination should be filed with the same office where the original security agreement was filed. If time is of the essence, the buyer should complete the UCC filings electronically, which have an immediate turnaround. Paper filings may take up to 30 days.

IP Due Diligence Considerations Based on the Type of Deal

Due Diligence for Asset Purchases and Carveouts

When negotiating asset purchases and carveouts, the buyer’s counsel should conduct due diligence on the transfers of IP rights, the seller’s employees, source code and data, and any material IP or IT contracts.

Since asset purchases and carveouts require the seller to assign and transfer IP rights to the buyer, the buyer must make additional confirmations to prevent future disputes. The buyer should first ensure that the applicable IP assets are able to be transferred under the applicable law. The buyer should also confirm that shared IP rights are appropriately allocated or cross-licensed between the parties post-closing.

When the transaction does not include all of the target’s employees or IP assets that are material to the purchased entity, the buyer must confirm whether:

- a key-person risk exists

- IT systems or data will need to be divided or moved

- the purchased IP assets can be used by the buyer post-deal

- transition services are necessary

When data or source code is transferred, it must be vetted.

The buyer should first confirm that the seller properly collected the data and then determine whether any third-party rights may restrict the transfer, such as third-party data containing personally identifiable information.

For example, Internet of Things (IoT) devices can gather large amounts of data, giving rise to potential legal issues concerning consent, notice, security, and privacy. If the data collected contains financial, health, or other personal information, the buyer should determine whether any of the data is subject to privacy or cybersecurity regulations and also investigate whether the persons whose data has been collected received proper notice and provided consent.

The buyer must also confirm that their planned uses of the data are permissible. Material IP and IT contracts should be reviewed as these contracts can be subject to certain arrangements such as change of control or anti-assignment provisions. The buyer should review whether any IP and IT contracts include these provisions. If they do not, then the buyer should determine the applicable state law.

Due Diligence for Technology Mergers and Share Acquisitions

In the case of a merger or share acquisition. There are certain public sites that buyer’s counsel should review. This includes:

- US Patent and Trademark Office (USPTO);

- Domain name registries;

- US Copyright Office;

- Uniform Commercial Code; and

- State trademark office databases.

These public sites should be used to confirm:

- status of the IP;

- chain of title;

- expiration date; and

- the scope of protection.

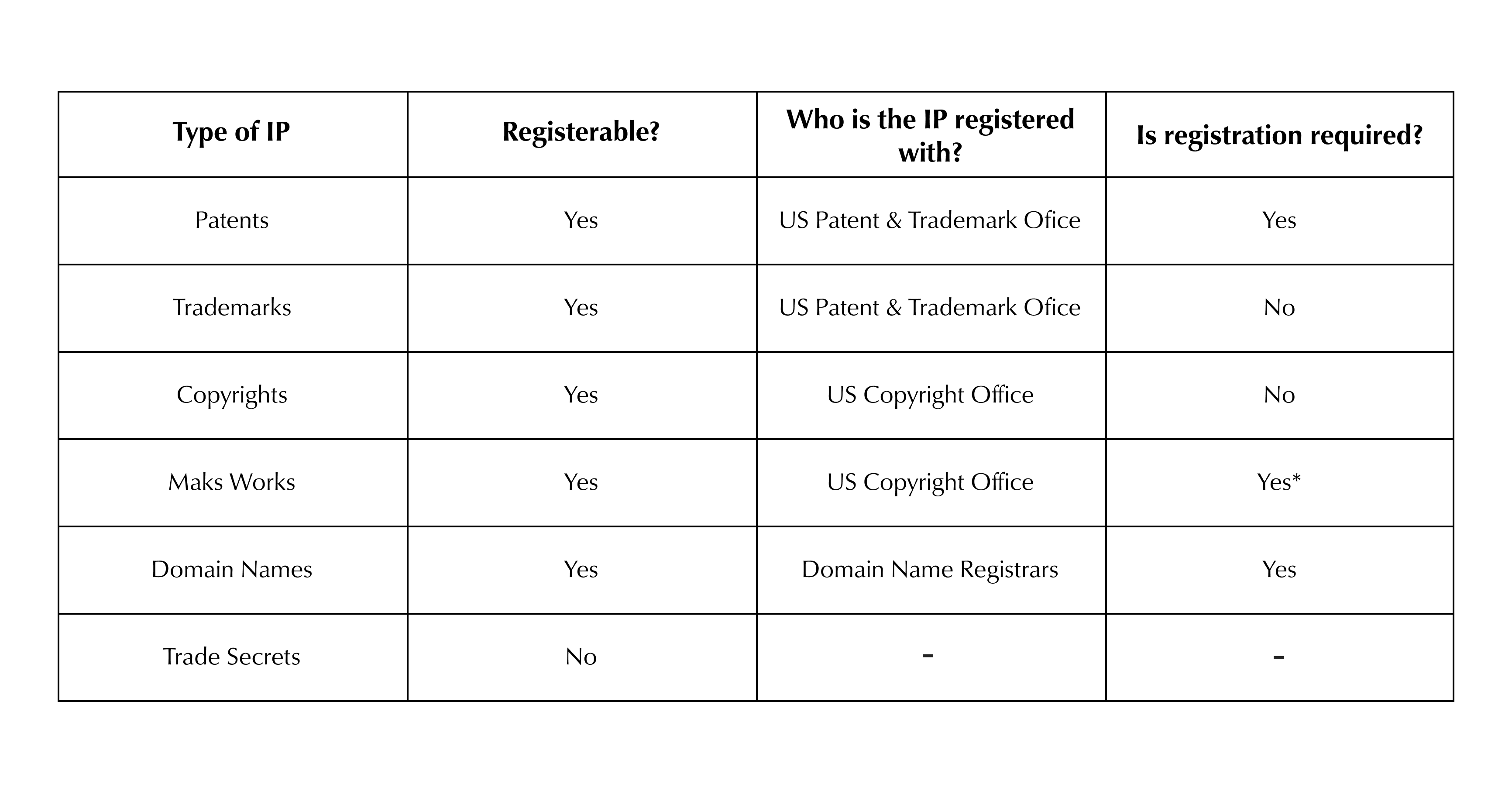

The required due diligence for the buyer depends on whether the IP in question is registrable. The chart below depicts the types of registrable IP, the entity the IP should be registered with, and whether registration is required.*Mask Works must be registered within two years of the date that the mask work is initially commercially utilized.

*Mask Works must be registered within two years of the date that the mask work is initially commercially utilized.

*Mask Works must be registered within two years of the date that the mask work is initially commercially utilized.

If the IP is registrable…

If the IP is registrable, the buyer should use the public sites (listed above) to determine whether:

- any third parties have trademark rights or freedom to operate (FTO) by conducting trademark clearance and availability searches;

- there are any active, unreleased liens or security interests held against the target’s intellectual property assets, by searching the Uniform Commercial Code, USPTO, and US Copyright Office databases;

- the target has not been involved in any litigation concerning its assets or other IP-related litigation by searching public US court dockets; and

- the target, if a public company, has material contracts or other public disclosures by searching the Securities and Exchange Commission’s database for annual or quarterly reports and other filings.

If the IP is not registrable…

If the IP is not registrable, the buyer should verify the seller’s ownership of the IP. If the IP is a trade secret, the buyer must also confirm that the seller has taken reasonable precautions to hold the trade secret in confidence.

Although unfortunate, it is important to remember that if the trade secret has lost confidentiality, the trade secret may no longer be protectable.

.jpeg)